Transition Plan 5.0: What It Is and How It Works? The Latest Details

The plan is designed to facilitate the digital and green transformation of businesses, making €6.3 billion available for the 2024-2025 period. Through tax credits, it encourages investment in technological assets, both tangible and intangible, with the goal of supporting the modernization of production processes in response to the challenges of digitalization and the energy transition.

PROJECT PERIOD AND ELIGIBILITY

Projects started from January 1, 2024, and completed by December 31, 2025, will be eligible for the benefits. The start date is considered to be that of the first legally binding commitment to order the assets involved in the investment.

ELIGIBLE TAX CREDIT

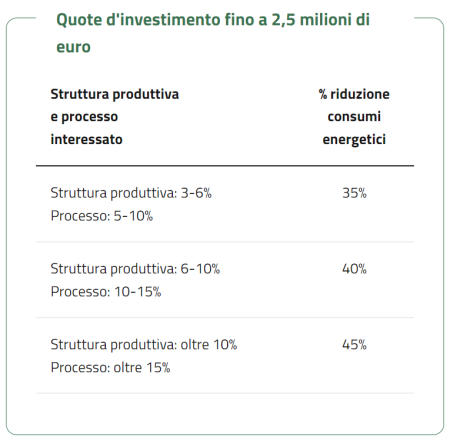

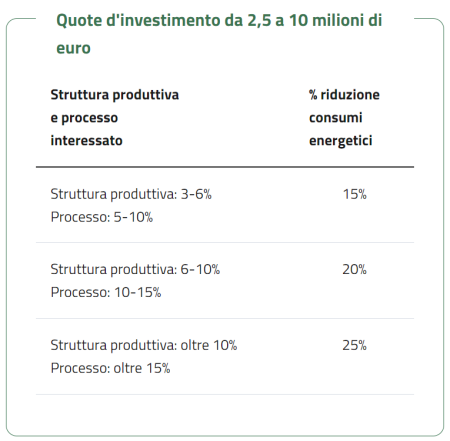

The amount of the tax credit varies according to the investment share and the reduction in consumption. The measure provides three intervention levels:

○ Up to €2.5 million.

○ Between €2.5 million and €10 million.

○ Between €10 million and €50 million.

No contribution is provided for investments exceeding €50 million.

PROCEDURE FOR ACCESSING THE INCENTIVE

Companies must follow a specific procedure to access the tax credit, different from that outlined in Decree 4.0:

○ Step 1 → Ex-ante Certification: a declaration and certification for investment projects, including capital goods, self-production devices, and personnel training. The certification must confirm the project’s validity in achieving energy efficiency goals.

○ Step 2 → Ex-post Certification: the company must submit a report, accompanied by certification confirming the level of energy efficiency achieved thanks to the investment.

CERTIFICATION BODIES

According to Article 15, paragraph 6 of the decree, the authorized entities are:

○ Energy Management Experts (EGE) certified according to the UNI CEI 11339 standard.

○ Energy Service Companies (ESCo) certified according to the UNI CEI 11352 standard.

○ Engineers registered in sections A and B of the professional register, industrial experts, and industrial experts with degrees registered in the "mechanical and energy efficiency" and "electrical and automation systems" sections, with skills and proven experience in the energy efficiency of production processes.

STAGES OF THE PROCEDURE

Companies will send a preliminary communication, accompanied by the Ex-ante Certification, through the “Transition 5.0” IT Platform accessible from the Customer Area of the Customer Area of the GSE's official website. Preliminary Communications will be evaluated and managed by the GSE, verifying only the completeness of the documents and information provided and compliance with the maximum eligible costs limit for each beneficiary company. Within 30 days of confirming the reserved credit, the company will send a communication relating to the orders accepted by the supplier with a down payment of 20% of the acquisition cost of the assets. At the end of the innovation project, the company will submit a Completion Communication, accompanied by the Ex-post Certification, containing the necessary information to identify the completed project.

WHY TRUST PHOX?

With industrial investments declining (Confindustria reports a -20% drop in capital goods orders by the end of June), the Transition 5.0 Plan opens a new season of opportunities for Italian companies but also imposes strict deadlines. Failure to meet the timelines will result in the loss of the incentive.

Relying on a partner like Phox, capable of ensuring compliance with deadlines and the success of the project, is therefore essential. With the expertise acquired during the Transition 4.0 Plan, Phox is ready to support companies in this new journey. We offer a wide range of services to assist companies in implementing their energy efficiency projects:

○ Design, implementation, and testing of industrial automation systems and energy consumption monitoring

○ Integration of existing hardware and software systems in the company

○ Consultancy on project financing to obtain the tax credits provided